The state pays several types of benefits to women on the occasion of pregnancy and childbirth. From February 1, 2018, the amounts of benefits established in 2017 were indexed. In addition, from January 1, 2018, the minimum wage was changed, now it is 9,489 rubles. In the article we provide a standard calculation of benefits and complex cases. A benefit calculator is attached.

To begin with, a little theory on the topic of how to apply for and calculate maternity benefits (maternity benefits), abbreviated as B&R benefits.

Who do we pay maternity benefits to?

The following categories are eligible for benefits:

- working,

- unemployed (dismissed due to the liquidation of organizations during the 12 months preceding the day they were recognized as unemployed),

- full-time students,

- undergoing military service under contract,

- who have adopted a child and belong to the above categories

Note: if the employee is a part-time worker and has worked for the same employers for the two previous years, then both employers pay her maternity benefits in 2018.

Maternity benefits are paid at the place of work, service or other activity. For women dismissed due to the liquidation of an organization, benefits are paid by social security authorities at their place of residence (place of actual stay or actual residence).

How to apply for maternity benefits?

Deadline for paying maternity benefits

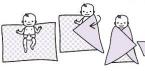

Maternity benefits are paid for the entire period of maternity leave: 140 calendar days (70 before childbirth and 70 after). When multiple pregnancy and at the birth of two or more children - 84 and 110. In the case of complicated births - 70 and 86 (Part 1 of Article 10 of Law No. 255-FZ).

The benefit is paid in advance for the entire period of incapacity indicated on the certificate of incapacity for work. Current legislation does not provide for partial payment of benefits or payment first for the prenatal and then for the postpartum period.

For accountants and chief accountants on OSNO and USN. All requirements of the professional standard “Accountant” are taken into account.

Payment of sick leave during pregnancy and application period

Having received from a woman an application for the assignment and payment of benefits and a certificate of incapacity for work due to pregnancy, the employer is obliged to pay the benefit within 10 calendar days.

From the first calendar day, benefits are paid from the budget of the Social Insurance Fund Russian Federation. The employer does not bear the cost of paying benefits. The application period is no later than 6 months from the date of the end of maternity leave.

If maternity leave is not formalized, there are no grounds for payment of benefits. The benefit is paid at 100%, regardless of length of service.

Documents - grounds for calculating maternity benefits:

- certificate of incapacity for work in the established form (the issuance procedure is approved by Order of the Ministry of Health of Russia dated June 29, 2011 No. 624n);

- certificate(s) about the amount of earnings from which the benefit should be calculated, from other places or a copy thereof (form approved by Order of the Ministry of Labor of Russia dated April 30, 2013 No. 182n);

- application for benefits (when contacting your HR department or accounting department, colleagues will help with the application form).

It is important not to miss the deadline for submitting documents when applying for maternity benefits - this is six months from the date of termination of maternity leave.

Amount of child benefits in 2018

- benefits for women registered for early pregnancy (up to 12 weeks) - 628.47 rubles,

- lump sum allowance at the birth of a child - 16,759.09 rubles,

- maternity benefit (maternity benefits) maximum:

- 282,106.70 - in the general case for 140 days of sick leave;

- 314,347.47 - for complicated childbirth (156 days of maternity leave);

- 390,919.29 - for multiple pregnancy (194 days).

- minimum (according to minimum wage):

- 43,615.65 - in the usual case for 140 days of sick leave;

- 48,600.30 - for complicated childbirth (156 days of sick leave);

- 60,438.83 - for multiple pregnancy (194 days of maternity leave)

- child care allowance up to 1.5 years ( maximum for working people) - 24,536.55 rubles.

New children's benefits in 2018

From January 1, 2018, families will be paid new monthly benefit until reaching 1.5 years at the birth of the first child in the amountregional subsistence level, as well as a similar monthly payment from funds maternity capital for the second child. Both payments are providednew law on child benefits in 2018, which was signed by the President on December 28, 2017 (law No. 418-FZ).

But these payments will not affect all families, but only those who meet three conditions:

- The child must be (adopted) born after January 1, 2018,

- Is a citizen of the Russian Federation,

- The average per capita family income does not exceed 1.5 times the subsistence level of the working-age population of the corresponding subject of the Russian Federation for the 2nd quarter of 2017. For example, for Kirov region- this is 15,238.5 rubles.

Online calculator for maternity leave in 2018

How to calculate maternity benefits

All the features of calculating benefits for temporary disability and in connection with maternity are reflected in the Regulations approved by Decree of the Government of the Russian Federation dated June 15, 2007 No. 375 “On the specifics of the procedure for calculating benefits for temporary disability, pregnancy and childbirth...”.

We will calculate maternity benefits based on average earnings.

Payments that should be included in the calculation

When calculating benefits for temporary disability, pregnancy and childbirth, and child care for children up to one and a half years old in 2018, the calculation of average earnings can include maximum payments for 2017 in the amount of 755,000 rubles, and for 2016 - in the amount of 718,000 rubles . (With according to clause 2 of article 14 of Law No. 255-FZ).

Billing period

The calculation period for calculating temporary disability benefits, maternity benefits, and childcare benefits for children up to one and a half years old will be the two years preceding the occurrence of the insured event. For example, if an employee fell ill or went on maternity leave in 2018, then the billing period will be from January 1, 2016 to December 31, 2017.

Replacing periods

If in two calendar years immediately preceding the year of occurrence of the specified insured events, or in one of the specified years, the insured person was on maternity leave and (or) child care leave, then the corresponding calendar years (calendar year) upon application the insured person may be replaced for the purpose of calculating average earnings by previous calendar years (calendar year), provided that this will result in an increase in benefits.

Please note that you can replace years or year with any previous years.

Actions of an accountant when calculating maternity benefits

Action 1: determine the amount of payments for the two years preceding the year the benefit was calculated.

Step 2: determine average daily earnings. To do this, divide the amount of earnings for two years by the number of calendar days in billing period, if the period has been fully worked out (in 2018 it should be divided by 366 + 365 = 731). Or minus days that should be excluded according to the law. Compare average daily earnings with the minimum and maximum amounts.

The billing period may consist of 730 calendar days (if the billing period consists of 2014 and 2015), as well as 732 calendar days (if the billing period includes 2012 and 2016) Letter of the Federal Social Insurance Fund of the Russian Federation dated March 3, 2017 No. 02-08-01/ 22-04-1049l.

Example of calculating maternity benefits

Petrova Valentina goes on maternity leave from June 10, 2018 for 140 calendar days. In 2016, the specified employee was on leave to care for her first child in the period from January 1 to September 30. In October 2016, Petrova did not work - she was on study leave and on leave without pay. Started work on November 1, 2016.

For the period from November 1 to December 31, 2016, she received a salary of 84,000 rubles.

salary - 781,000 rubles;

vacation pay - 34,000 rubles.

Total for 2017 - 815,000 rubles.

Petrova Valentina did not provide an application for a replacement for 2016. Accordingly, the calculation period includes 2016 and 2017.

We will determine the amount of maternity benefits.

Solution

- Determining the billing period

366 – 273 + 365 = 458 days

Please note that in 2016, days of study leave and unpaid leave are not excluded from the calculation period. Only the period of parental leave was excluded.

- Determining payments that should be included in the calculation

84,000 + 755,000 = 839,000 rub.

Please note that in 2017 we will take into account only RUB 755,000. - the size of the maximum base for calculating insurance premiums.

- Determining the average daily earnings

839,000 / 458 = 1,831.88 rubles.

- We determine the amount of maternity benefits.

1,751.09 x 140 = 256,463.2 rubles.

Calculation of benefits based on the minimum wage

If:

- the pregnant employee had no earnings during the billing period;

- or the average earnings calculated for this period, calculated for a full calendar year, are below the minimum wage,

then the average earnings, on the basis of which benefits are calculated, are taken to be equal to the minimum wage (the federal minimum wage as of January 1, 2018 is 9,489 rubles).

When calculating, the federal minimum wage should be used ( clause 1.1 art. 14 of Law No. 255-FZ).

If the insured person, on the date of the occurrence of the insured event, works part-time (part-time, part-time), the average earnings, on the basis of which benefits are calculated, in these cases, are determined in proportion to the duration of the insured person’s working hours. Also, if the calculation is made based on the minimum wage, the regional coefficient should still be applied.

Benefits are also calculated from the minimum wage if this is a woman’s first job and she goes on maternity leave without working for six months.

In all cases, the monthly child care benefit cannot be less than the minimum monthly child care benefit established by the Federal Law “On State Benefits for Citizens with Children” dated May 19, 1995 No. 81-FZ.

Calculation of child care benefits up to 1.5 years

If, when calculating temporary disability benefits, no periods are excluded from the calculation period, then when calculating child benefits, the following should be excluded from the calculation period:

- periods of temporary disability;

- periods of maternity and child care leave;

- periods of release of an employee from work with full or partial retention of wages, for which insurance contributions were not charged.

Not excluded additional paid days off to care for disabled children.

If the billing period has been fully worked out, then the actual number of days in the years of the billing period should be included in the calculation. For example, when calculating child benefits in 2018, with a fully worked out calculation period, 731 days should be included in the calculation: 366 days in 2016 and 365 days in 2017.

Actions of an accountant when calculating child care benefits for children up to one and a half years old

Action 1: determine the amount of payments for the two years preceding the year the benefit was calculated.

Step 2: determine the average daily earnings in the same way as determining the average daily earnings for calculating maternity benefits.

Step 3: compare average daily earnings with the minimum and maximum amounts.

Step 4: multiply average daily earnings by 30.4 days.

An example of calculating child care benefits for children up to one and a half years old

Immediately after maternity leave, the employee provided Required documents to assign her child care benefits up to one and a half years old.

We will determine the amount of childcare benefits for children up to one and a half years old, based on the average daily earnings of 1,549.23 rubles.

Solution

The benefit will be:

1,549.23 x 30.4 x 40% = 18,838.64 rubles.

Please note that it is imperative to compare the amount of the calculated benefit with the amount of the benefit calculated from the maximum (based on the maximum base for calculating insurance premiums) and minimum values (based on the minimum wage).

An example of calculating benefits when the employee was on maternity leave during the billing period and worked part-time

Engineer Bulkina N.V. has been working at Krug LLC since 2008.

On January 1, 2017, she went on maternity leave, and from May 21, 2017, on maternity leave for up to one and a half years. Bulkina started working part-time on October 1, 2017. And from February 1, 2018, she again goes on maternity leave (continues what she started on May 21, 2017).

IN in this case, child care benefits will have to be calculated based on the new billing period. Since the case occurs already in 2018. Accordingly, we will include the years 2016 and 2017 in the calculation.

What needs to be excluded from the calculation:

- the period of maternity leave, from January 1, 2017 to May 20, 2017, which fell in 2017,

- time to care for a child up to one and a half years from May 21 to December 31, 2017, regardless of the fact that Bulkina worked part-time from October 1, 2017 to December 31, 2017.

BUT! Salaries for the period from October 1, 2017 to December 31, 2017 should not be excluded, since insurance premiums were calculated on it!

In the online course “Salaries. Average earnings" - you will learn how to correctly calculate average earnings in all possible situations, including when paying benefits.

To display the form, you must enable JavaScript in your browser and refresh the page.

In 2020, the minimum amount of maternity benefits for a normal pregnancy from one employer will increase to 55.8 thousand rubles, and the maximum - 322.2 thousand rubles. (with a vacation of 140 days). You can read how to calculate maternity benefits in 2020 and write an application in this article (with examples). Personal income tax is not withheld from maternity payments.

Maternity benefits are not paid to non-working/unemployed citizens.

Maternity benefits

Maternity benefits are paid in total for the entire vacation (maternity leave) lasting:

- 70+70 calendar days (before childbirth + after childbirth);

- 70+86 calendar days in case of complicated childbirth;

- 84+110 calendar days for the birth of two or more children.

Maternity leave is calculated cumulatively and is provided to a woman completely regardless of the number of days actually used before giving birth, for example, the next leave.

Working For women subject to compulsory social insurance, maternity benefits are set at 100% of average earnings. According to the norms of Federal Law No. 255, from January 1, 2011, average earnings are calculated for the two calendar years preceding the year of maternity leave.

Amount of maternity leave in 2020

The amount of maternity payments cannot be less than 55.8 thousand and more than 322.2 thousand rubles for 140 days of vacation. Let us explain: the amount of the benefit is calculated by multiplying the woman’s average daily earnings by the number of vacation days, while

The maximum amount of average daily earnings is limited. It cannot exceed the value determined by dividing by 730 the sum of the maximum values of the base for calculating insurance premiums for the two calendar years preceding the year of maternity leave (Part 3.3 of Article 14 of Law No. 255-FZ).

The law states that we divide by 730 (regardless of whether the periods fall on a leap year), i.e. when going on maternity leave in 2020, the maximum amount of average daily earnings will be (815,000 + 865,000) / 730 = 2,301.37 rubles. To calculate max. size of the payment, the resulting amount should be multiplied by the number of vacation days. To calculate, you can use the maternity benefits calculator.

A woman with less than six months of insurance coverage is paid maternity benefits in the amount of the minimum wage (minimum wage) for every month of vacation. Since January 2020, the minimum wage is 12,130 rubles. The insurance period includes all periods during which a citizen was subject to compulsory social insurance in case of temporary disability and in connection with maternity.

Recipient categories

Dismissed due to liquidation organizations, maternity benefits are set at 655.49 rubles per month. To do this, you must register with the employment center within 12 months from the date of dismissal.

Note!

The specified benefit amount will be indexed from February 1, 2020.

For the unemployed maternity benefits are not provided for mothers, since this is compensation for earnings, which future mom receives less due to going on maternity leave. But a non-working mother does not have such income.

Maternity leave for individual entrepreneurs possible if they are in voluntary social insurance for individual entrepreneurs in the FSS (social insurance fund) and have paid contributions for the year preceding the year of maternity leave.

Necessary documents for applying for maternity benefits:

- Sick leave from antenatal clinic;

- Certificate of income from previous place of work (if available) length of service from other employers for the pay period).

- If you were fired due to the liquidation of the company, your benefits need to get in Social Security, but to do this you need to register with the employment center.

- If the employer cannot pay maternity benefits (there is no money in the account), the benefit is paid territorial body insurer (see the name of the insurance company on your compulsory medical insurance policy).

Deadlines for applying for and paying maternity benefits

Apply no later than six months from the end of maternity leave. The benefit is assigned within 10 days after all documents are submitted.

Pay attention to other child benefits that are established by Federal Law No. 81-FZ “On State Benefits for Citizens with Children”

During pregnancy and the first time after childbirth, the state continues to provide financial support to mothers in the form of maternity benefits. This type of social guarantee is provided to working (employed) women during maternity leave, in a guaranteed minimum amount that is a multiple of the minimum wage (the minimum wage from January 1, 2019 is 11,280 rubles).

- dated May 19, 1995 No. 81-FZ “On state benefits for citizens with children”;

- dated December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”.

Maternity benefits are paid depending on social status recipient at the expense of the Social Insurance Fund (SIF) by enterprises or from the federal budget by educational organizations or the Department of Social Protection of the Population (USPP).

Maternity payments are provided at a time:

- expectant mothers who are studying full-time in institutions providing vocational, secondary specialized or higher education;

- unemployed women dismissed as a result of the reduction or liquidation of the employer.

Amount of maternity benefit in 2019

Maternity pay since 2011 is calculated according to a certain procedure, which has the following features. During pregnancy, the employee is required to take maternity leave, for all days of which benefits are paid. The legislation provides several options for its duration:

- at the birth of one child, 70 days before and 70 days after birth are provided (in case of complications of childbirth, postpartum leave of 86 days is provided);

- for the birth of 2 or more children, 84 days are provided before and 110 days after birth.

Attention

They include payment for all days of maternity leave in an amount equal to 100% of the woman’s average earnings for the last two full calendar years. For non-working mothers entitled to this benefit, regional USZNs accrue in the amount RUB 655.49 per month.

If a woman worked at several enterprises at the same time, then the accrued salaries for two years are summed up. If she continues to combine work in several organizations, then maternity benefits are paid at one enterprise of her choice.

If the average woman's earnings less than the current minimum wage at the time of going on maternity leave or the total insurance period is less than six months, then to calculate the benefit, the minimum wage is taken, the amount of which in 2019 is 11280 rub..In addition, the maximum amount of payments has been established. It should not exceed the size maximum contribution base compulsory social insurance in case of temporary disability and in connection with maternity, which are:

- in 2009 and 2010 - 415,000 rubles;

- in 2011 - 463,000 rubles;

- in 2012 - 512,000 rubles;

- in 2013 - 568,000 rubles;

- in 2014 - 624,000 rubles;

- in 2015 - 670,000 rubles;

- in 2016 - 718,000 rubles;

- in 2017 - 755,000 rubles;

- in 2018 - 815,000 rubles;

- in 2019 - 865,000 rubles.

Therefore, in 2019, maternity benefits were accrued and paid in amounts not exceeding the following values:

Read more about the amount and calculation of accruals on the page Amount of maternity benefits.How are maternity benefits calculated?

To receive maternity benefits, a pregnant woman must meet following conditions:

- be officially employed;

- be registered for pregnancy at a antenatal clinic or other medical institution;

- in accordance with the certificate of incapacity for work, to be on sick leave for pregnancy and childbirth.

The exceptions are the following categories of unemployed:

- were laid off during the year due to reduction within no more than 12 previous months and were duly registered with the Employment Center;

- study in an educational organization on a full-time basis.

If you belong to the category of citizens who are entitled to maternity benefits, then to receive it you must:

- Obtain from a antenatal clinic or other medical institution a certificate of registration for pregnancy, indicating the date of registration.

- Apply for maternity leave from your doctor.

- If you work, or two last year worked at several enterprises, it is necessary to obtain certificates from these organizations on the calculation of average earnings, for subsequent submission to the employer’s department, which will make the payment.

- Write an application addressed to the director of the enterprise - employer about going on maternity leave and receiving maternity benefits.

- All prepared documents must be submitted to the human resources department of the organization.

Attention

If during this period the management of the enterprise does not make any decision and does not make payments, then the woman has the right to apply for benefits to the local branch of the Social Insurance Fund (SIF).

Maternity payments for a non-working mother

Unemployed women in 2019 have the right to receive maternity benefit at the rate of RUB 655.49 per month, if they:

- are registered with the Employment Service (ESS) as persons who have lost their jobs due to layoffs from an enterprise during its liquidation (or termination of activities in the form of individual entrepreneurs or self-employed people);

- study full-time in educational organizations at various levels - paid in the form of a scholarship.

To receive payment unemployed woman must provide:

- statement;

- sick leave from a medical institution;

- work book or an extract with marks from the last place of work;

- a certificate from the Employment Service confirming registration as unemployed.

The decision to receive benefits is made within 10 days from the date of application. You can apply for maternity benefits any day after receiving maternity leave, but no later than 6 months after its completion.

RedRocketMedia

Bryansk, Ulyanova street, building 4, office 414

Today there is no such thing as a “maternity leave”. The concept of “maternity leave” combines the pre- and postpartum periods. But it is more correct to divide this period into maternity leave and parental leave. During each of these periods, the young mother is provided with support in the form of benefits.

Benefits before birth

Not all women can count on benefits before childbirth. These benefits are received by:

- working women at their place of work;

- women dismissed due to the liquidation of the organization in the MFC;

- military personnel at the place of duty;

- full-time students at their place of study.

One-time benefit when registering in the early stages of pregnancy

Size from January 1, 2018 - 613.14 rubles. From February 1, 2018 - 628.47 rubles. This is due to the fact that from February 1, 2018, the allowance for registration with early dates pregnancy was indexed by a factor of 1,025 (Resolution of the Government of the Russian Federation dated January 26, 2018 No. 74 “On approval of the amount of indexation of payments, benefits and compensation in 2018”)

Documents: certificate from the antenatal clinic and application for payment. It is accrued together with maternity benefits, but if the certificate is provided later, then the accrual must be no later than 10 days from the date of submission.

Maternity benefit (one-time)

It is paid in a lump sum for the entire period of maternity leave (140 calendar days, 168 in the case of complicated childbirth and 194 in the case of the birth of two or more children).

Amount - 100% of average earnings for the previous two years before going on maternity leave, but not more than 266,191.80 rubles. (taking into account that the pregnancy is singleton, childbirth will take place without complications and maternity leave will be 140 days). In 2018, the size of payments will increase by 3,500 rubles. This increase is due to the fact that when calculating payments, the average salary for 2016-2017 will be taken as a basis. For those who have not accumulated 2 years of work experience, the benefit for the missing amount of time will be calculated based on the amount of 9,489 rubles. This is also the starting value when calculating benefits for the unemployed. In the amount of the scholarship - for students; in the amount of allowance - for military personnel.

Documents: sick leave for pregnancy and childbirth and application for payment. The benefit is paid 10 days after submitting the application.

Postpartum benefits

After giving birth, a woman can count on benefits from the state and regional authorities. All women are entitled to these benefits; the only difference is in the amount and method of receipt.

One-time benefit for the birth of a child (from the state)

This benefit is received by all young mothers without exception, its size is the same for everyone, in January 2018 - 16,350.33 rubles, starting from February 2018 - 16,873.54 rubles.

Working mothers receive this benefit at their place of work. Non-working mothers at the husband’s place of work or at the MFC, if both do not work. Students at their place of study, and military personnel at their place of service.

Documentation:

- certificate No. 24 from the registry office;

- child's birth certificate;

- application for benefits;

- a certificate from the second parent’s place of work stating that he did not receive this benefit; if the second parent does not work, then a work book.

After submitting the application, the benefit arrives within 10 days.

Monthly allowance for child care up to 1.5 years (from the state)

Working women receive benefits at their place of work, non-working women at the MFC, students at their place of study, and military personnel at their place of service. The benefit must be applied for before the child turns 1.5 years old.

At the place of work, the amount is 40% of average earnings, but not less than RUB 3,163.79. for the first child. Non-working parents receive the minimum amounts listed above. According to the law signed by the President on December 21, 2017, every family that has a baby can count on a monthly financial assistance until the child reaches 1.5 years of age in the amount of the regional subsistence minimum

Documentation:

- application for benefits and parental leave for up to 1.5 years;

- birth certificate;

- a certificate that the second parent is not on vacation and does not receive benefits, or a work book if the second parent is not employed.

The money will arrive monthly on payday or to a card, the details of which will be indicated when submitting documents to the MFC.

One-time compensation payment at the birth of a child at the expense of St. Petersburg

Issued only to parents permanently registered in St. Petersburg; at least one must be registered. The benefit is credited to the Children's plastic card. The card can be issued at any branch of the MFC. The application period is 1.5 years from the date of birth of the child.

The amount of payments in 2018 at the birth of the first child is 29,839 rubles, 39,788 rubles. for the second, 49,733 rubles. at the birth of the third and subsequent children. This money cannot be cashed out, but you can use the card to buy children's goods in children's stores, large hypermarkets, and online stores. Production time: 1.5-2 months.

Documentation:

- child's birth certificate;

- birth certificates of older children;

- marriage/divorce certificate;

- form No. 9 from the passport office;

- passports of both parents;

- a certificate from the antenatal clinic confirming registration for up to 20 weeks; application for benefits.

Monthly allowance for a child up to 1.5 years old at the expense of St. Petersburg

At the MFC, parents who are permanently or temporarily registered in St. Petersburg can receive payments, provided that they belong to low-income families. Each family member should have no more than 15,674 rubles. 25 kopecks. (family income also takes into account all benefits the family receives).

Pregnancy – great time in a woman's life, but at the same time headache her employer. The manager must know how to calculate and pay maternity benefits, within what time frame the transfer must be made, and what affects the amount of the benefit. Let's take a closer look at maternity leave, and also look at the features of calculating maternity benefits and the procedure for transferring them.

In ordinary life, maternity leave, as a rule, refers to the entire period while a woman is freed from work in order to bear, give birth to, and care for a child until he is 3 years old. But the legislation divided this concept into 2 segments: (basis - Article 255 of the Labor Code of the Russian Federation) and (basis - Article 256 of the Labor Code of the Russian Federation). While the monthly social payment for child care is consistently 40% of average earnings, the calculation of maternity benefits has its own characteristics.

Calculation of maternity payments

To correctly calculate maternity payments, let’s turn to the procedure established by law. To begin with, we note that the period for which a one-time maternity benefit should be calculated is 140 days, for a multiple pregnancy - 194 days, and for a difficult birth - 156 days. All this is reflected in Art. 10 Federal Law No. 255-FZ. It also says that in the case when a woman is on leave to care for an already born child and is about to give birth to another, she needs to choose only one of the two benefits provided.

The period for which the lump sum maternity benefit should be calculated is 140 days.

Maternity benefits are paid to a woman in the amount of 100% of her salary. The length of her official work may have some influence. If it is less than six months, then the rate of the minimum wage - minimum wage (in 2018 it is 9,489 rubles) is taken as an indicator of average monthly earnings; coefficients are also taken into account.

Formula general definition maternity pay includes 3 amounts:

- The employee’s income for the previous 2 years (if, for example, the calculation is made in 2018, then 2016 and 2017 are taken).

- The number of days in this period (730 or 731 days if the year was a leap year).

- The number of maternity days required for calculation (140, 156, 184).

Rules for calculating benefits

There are certain restrictions and rules for calculating benefits. According to clause 3.2 of Art. 14 of Federal Law No. 255-FZ, the annual average earnings of an employee going on maternity leave cannot be higher than the maximum base amount for calculating insurance premiums. In 2018, this amount is set at 815,000 rubles, but you need to calculate the amount of maternity benefits based on the previous 2 years, so you need to know their limit.

In 2017, the maximum base for calculating insurance premiums was 755,000 rubles, and in 2016 – 718,000 rubles. When calculating maternity benefits in 2018, you must take these amounts into account.

Maximum benefit amount: (755,000 + 718,000) / 730 × 140 = 282,493 rubles 15 kopecks. Minimum size benefits in 2018: (7500 × 12 × 2) / 730 × 140 = 43,675 rubles 40 kopecks.

The maternity leave calculator can be programmed at the enterprise independently (for example, in Microsoft Excel) or the payments can be determined manually.

Income for the previous 2 years does not include sick leave, prior maternity leave, as well as payments made for any other periods during which statutory insurance premiums were not charged on income received. If it so happens that the employee was on maternity leave during the previous 2 years required for calculation, then she can completely replace one or both calculation years with previous years. This way she can increase the benefit amount. That is, in this case, she has the right to choose the years for which her maternity leave is calculated.

As mentioned above, the employee’s length of service may affect the amount of maternity benefits. What should an employer do if his employee has 1 year of experience? The rule is the same for all officially employed women, so the calculation period will also be the previous 2 calendar years. In this case, the actual time worked, which falls on the previous calendar year, is taken in the amount of 100% of average earnings (say, 5 last months that year), for the remaining months (in our example there are 19), earnings are set at the minimum wage.

The employee's length of service may affect the amount of maternity benefits. The rule is the same for all officially employed women.

At the same time, the maternity calendar is different for each employee, but the calculation of the benefit itself is carried out according to the same formula.

How are maternity benefits calculated?

As soon as the pregnancy reaches 30 weeks, the gynecologist at the antenatal clinic issues a sick leave certificate. It indicates the days for which maternity leave is paid.

The employee must provide the following documents to the accounting department or human resources department:

- Certificate of incapacity for work for pregnancy and childbirth.

- Certificate of early registration, if relevant (required for additional lump sum payment in favor of a pregnant employee).

- Your own statement in free form. You can see a sample.

- A certificate of actual earnings received for the previous 2 years in the form established by Order of the Ministry of Labor No. 182n. It is provided if the employee has worked in another company over the past 2 years.

Maternity sick leave is paid in accordance with the general procedure, according to Art. 15 of Federal Law No. 255-FZ. Within 10 days from the date of receipt of documents from the employee, benefits are calculated and accrued, and payment is made on the next day of payment of wages. The payment deadline must be observed - for violation by the employer, according to Art. 236 of the Labor Code of the Russian Federation, is obliged to pay a penalty. The surcharge for late payments is 1/300 of the established Central Bank refinancing rate for each day overdue.

The employer assigns and pays maternity benefits. The state compensates the funds paid by the employer, as stated in Art. 4 of Federal Law No. 81-FZ. Employees of the Social Insurance Fund transfer these funds within 10 days to the employer’s account. By the way, maternity benefits are taxed (Article 217 of the Tax Code of the Russian Federation).

Maternity leave benefits are not taxed.

Additional payments

In addition to basic sick leave pay, employees going on maternity leave are entitled to additional payments:

1. One-time payment.

It is fixed, set taking into account the annual indexation and until February 1, 2017 it amounts to 15,382 rubles 17 kopecks. A one-time payment is made to only one parent. To receive it, you must provide the employer with the child’s birth certificate, an application from the parent applying for the payment, and a certificate stating that the other parent has not received this payment and does not plan to.

2. Payment for early registration at the antenatal clinic.

The 12th week of pregnancy is the milestone before which you must register in order to receive this payment. Until February 1, 2017, it is 576 rubles 83 kopecks and is paid simultaneously with maternity benefits. To receive a one-time payment, the employee must provide the accounting department with a corresponding certificate from the antenatal clinic.

The basic benefit and additional payments are also due if a woman, being pregnant after 30 weeks, continues to work and maintains her salary. However, as soon as maternity leave turns into parental leave, the social monthly benefit will be paid only if the woman is part-time or working at home ().

If the employee continues to work after 30 weeks and receives wages, she must still be paid benefits.

Some formalities

Before going on vacation, immediately after it, or after 3 years have passed since the birth of the child, the employee has the right to go on vacation if she wishes, and her work experience does not affect the situation (). Some women take such leave after the paid 140 days have passed because they receive a little more money than child care benefits, thereby stabilizing their financial situation a little.

A pregnant woman or a woman caring for a child under 3 years of age is not allowed. Based on Art. 261 of the Labor Code of the Russian Federation, dismissal is possible only in the case of an agreement with a pregnant woman, but with its extension until the moment of childbirth or on her initiative at any time. If termination employment contract However, it happened, the woman is entitled to calculated compensation. She has the right to receive money for the next vacation of the previous period.

Maternity payments are due to every officially employed woman who is going to become a mother. They amount to 100% of her average earnings for the previous 2 years. The manager must pay her benefits, but not from his own pocket, but from the Social Insurance Fund. Any delay in payments is “punishable” by law, so you should be careful in fulfilling your duties.