Russian President Vladimir Putin signed the federal law "On the budget of the Pension Fund of the Russian Federation for 2016" *.

The PFR budget for 2016 takes into account the costs of paying pensions, social benefits, and maternity capital. The total expenditures of the PFR budget in 2016 will amount to 7,703.9 billion rubles (including the distributive component of the budget - 7,421.6 billion rubles). The PFR expenditure budget will amount to 9.8% of the GDP of the Russian Federation.

Indexation of pensions

The PFR budget includes expenses for indexing insurance pensions of non-working pensioners by 4% from February 1, 2016. The indexation of the fixed payment to the insurance pension in 2016 will be made in the same way from February 1 by 4%. The amount of the fixed payment after indexation will amount to 4,558.93 rubles per month, the cost of the retirement point - 74.27 rubles (in 2015 - 71.41 rubles).

The average annual old-age insurance pension in 2016 will be 13,132 rubles, which corresponds to 149.2% of the pensioner's subsistence minimum.

From April 1, 2016, the size of the social pension will be indexed by 4%. As a result, in 2016 the average annual social pension will amount to 8,562 rubles.

The expenditures of the Russian Pension Fund on the payment of pensions and benefits in 2016 are planned at the level of 6,539.1 billion rubles (this is 104.2% higher than in 2015).

Of these, expenses for the payment of an insurance pension are planned in the amount of 5,972.9 billion rubles. This is 134.7 billion rubles (102.3%) more than planned for the payment of insurance pensions in 2015 (5,838.2 billion rubles).

At the same time, as before, in 2016 there will be no pensioners in Russia whose monthly income is below the subsistence minimum of a pensioner in the region of residence. All non-working pensioners will receive a social supplement to their pension up to the level of the pensioner's subsistence minimum in the region of residence. To pay federal social supplements to pensions for 2.7 million people, the PFR budget for 2016 allocated 44.3 billion rubles.

Number of pensioners

It is predicted that during 2016 the number of pensioners receiving pensions through the PFR will increase by more than 546 thousand people - from 42.7 million to 43.2 million. The increase in the number of pension recipients in the PFR compared to 2015 is associated with a natural increase in the number of pensioners in the Russian Federation.

The main type of pensions in Russia in 2016 will be an insurance pension. The number of its recipients at the beginning of 2016 will be more than 39 million people. More than 3.5 million people are recipients of state pensions, while about 3.1 million pensioners are recipients of social pensions.

Benefits and social benefits

The Pension Fund of Russia provides social benefits to over 15 million federal beneficiaries: veterans, disabled people, Heroes of the Soviet Union, Heroes of Russia, etc.

In accordance with the PFR budget, on April 1, 2016, the size of the monthly cash payment will be indexed by 6.4%. In 2016, the Russian Pension Fund will allocate 419.4 billion rubles for the payment of monthly income (9.3 billion rubles more than in 2015).

Russians caring for disabled citizens will continue to receive compensation payments of 1,200 rubles a month. The cost of these payments in 2016 is planned at 34.8 billion rubles. The Pension Fund of Russia makes monthly payments of 5,500 or 1,200 rubles a month to non-working parents of children with disabilities and disabled children. The expenses for these payments in 2016 are planned at the level of 32.1 billion rubles.

Maternal capital

In 2016, the Russian Pension Fund will continue to issue state certificates for maternity (family) capital, as well as payment of maternity capital funds. In accordance with the PFR budget, 304.3 billion rubles will be allocated for these purposes in 2016.

Within the budgetary allocations for 2016, funds were taken into account for the provision in 2016 of a one-time payment in the amount of 20 thousand rubles (4.2 billion rubles based on their number of 209.4 thousand people). To date, over 6.5 million families in Russia have received a certificate for maternity capital from the Pension Fund of Russia, more than 3.3 million of them have fully disposed of its funds.

Social programs

In 2016, the budget of the Pension Fund of Russia allocated 1.0 billion rubles for the provision of subsidies to the budgets of the constituent entities of the Federation for social programs. Subsidies are provided for social programs related to strengthening the material and technical base of social service institutions, providing targeted social assistance to non-working pensioners and teaching computer literacy to non-working pensioners on the basis of co-financing the expenses of the constituent entities of the Russian Federation.

The provision of such subsidies is an annual practice of the Russian Pension Fund. The main directions of subsidies are the construction and repair of social service institutions, the purchase of technological equipment and durable goods by the constituent entities of the Russian Federation. Targeted assistance is provided to non-working pensioners for partial compensation for damage in connection with emergencies or natural disasters.

Receipt of insurance premiums

The volume of receipts of insurance contributions for compulsory pension insurance in 2016 is projected at the level of 4,060.35 billion rubles. In particular, it is predicted that contributions from the self-employed population (payers who do not make payments to hired workers) will reach 81.58 billion rubles, additional insurance premiums for workers employed in hazardous or hazardous industries (according to lists No. 1, 2, etc.) n. to "small" lists) - 90.76 billion rubles.

The calculation of the receipts of insurance premiums for MPI was carried out on the basis of the forecast of the Ministry of Economic Development of the Russian Federation for the wage bill in the country for 2016 in the amount of 19,903 billion rubles.

The rate of insurance premiums for OPS for employers using hired labor remains the same: 22% + 10% from payments exceeding the maximum base for calculating insurance premiums (in 2016 - 796 thousand rubles per year).

In terms of revenues, the PFR budget for 2016 was formed in the amount of 7,528.8 billion rubles (including the distributive component of the budget - 7,421.6 billion rubles), which is 105.3% more than in 2015.

The difference between revenues and expenditures of the PFR budget is due to the movement of pension savings in terms of expenditures: more than 280 billion rubles will be transferred to non-state pension funds as part of the 2015 transition campaign or paid to pensioners and legal successors. Income from pension savings in the amount of about 107 billion rubles will be formed from income from their investment by the Pension Fund of Russia and management companies, additional insurance contributions from participants in the state co-financing pension program.

*. Adopted by the State Duma of the Russian Federation on December 4, 2015, approved by the Federation Council on December 9, 2015.

The PFR performs all of its socially significant functions through the use of funds available in the organization's budget. In this regard, the procedures for its formation and spending are the most important part of the fund's work.

How is the budget approved? How is it replenished and what is it spent on? What measures are taken if the revenue part exceeds the expenditure side and vice versa? Let's consider these issues in this article.

The procedure for consideration and adoption of the budget

The budget of the Russian pension fund is being approved by the highest legislative bodies of the state. The following order is used:

- The preliminary draft budget is sent to the State Duma of the Federal Assembly of the Russian Federation;

- The Duma considers it and, if adopted, issues a separate law "On the PFR budget for ..." (it consists of main articles and annexes);

- The law is subject to consideration by the Federation Council (Upper House of the Russian Parliament), which must approve it in order for the document to come into force.

The texts of all laws approved in this way are posted in the public domain, both on the website of the Pension Fund itself and on the website of the State Duma, and subsequently anyone can familiarize themselves with their content.

If, after the budget has already been adopted, it is required to make some changes to it (this happens quite often, for example, due to economic circumstances, etc.), a draft of the planned changes is sent to the State Duma. Then they are introduced in a similar way, similar to that described above (a law is issued, a vote on adoption is launched, etc.).

Income

The PFR budget, approved for 2017, amounted to 8 trillion 363.5 billion rubles, in 2016 it was equal to 7.625 trillion rubles. This is almost 500 billion (or 7%) more than in 2015. The table below shows the dynamics of the Pension Fund's income since 2010:

Table 1. The structure of income of the Pension Fund of Russia in 2010-2017

| Year |

Budget (trillion rubles) |

|---|---|

| 2010

|

4,6

|

| 2011

|

5,25

|

| 2012

|

5,89

|

| 2013

|

6,39

|

| 2014

|

6,16

|

| 2015

|

7,1

|

| 2016

|

7,6

|

| 2017

|

8,36

|

Source: PF RF data, calculation of the Insurance Portal

As you can see, the total incomes gradually increased, but not very significantly, which is quite natural given inflation. In 2014, there was a slight decline associated with the main preparatory measures of the pension reform (the principle of calculating the insurance pension based on the new formula was changed, the so-called pension coefficient was introduced, etc.), but later the growth stage began again.

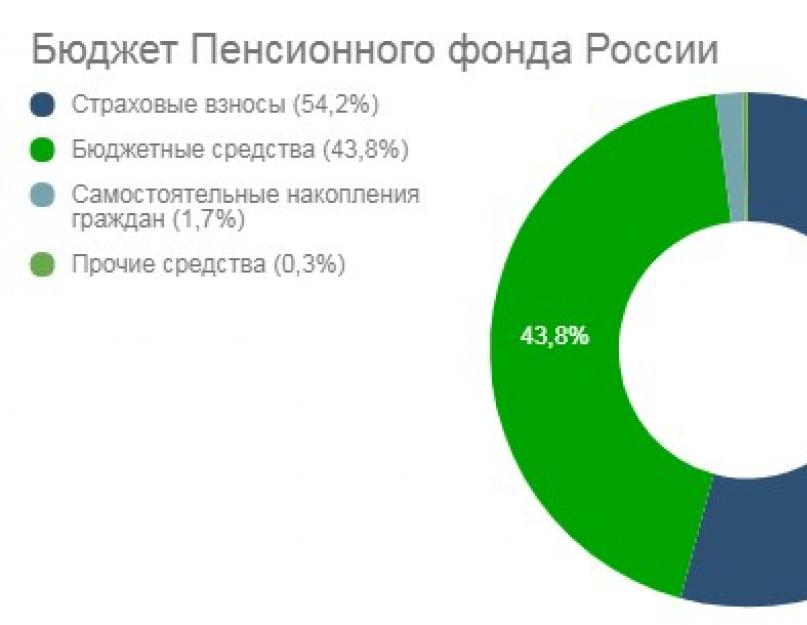

The pension fund's budget is replenished through several main sources:

- Income from the transfer of insurance premiums by employers - 4.13 trillion rubles (54.2% of the total volume of all income);

- Transfer of funds to the FIU from the federal budget of the state:

- to increase the size of insurance pensions (due to their valorization and indexation) and financing preferential pensions (in particular, we are talking about early retirement benefits) - 2.06 trillion rubles (27.1%);

- to cover the costs of providing social assistance to citizens: disability benefits, additional payments to pensions, maternity capital, etc. - 1.27 trillion rubles (16.7%);

- Income associated with the independent creation of pension savings by citizens (through the use of management companies, the Central Bank, NPF and voluntary contributions) - 131.2 billion rubles (1.7%).

Classification of income by period

The amounts of insurance contributions to the PFR budget in the period from 2010 to 2017 are shown in the table below:

| Year |

Budget (trillion rubles) |

|---|---|

| 2010

|

1,9

|

| 2011

|

2,8

|

| 2012

|

3,0

|

| 2013

|

3,46

|

| 2014

|

3,69

|

| 2015

|

3,86

|

| 2016

|

4,13

|

| 2017

|

4,42

|

In this statistical calculation, one can note the extremely low collection of insurance premiums in 2010 (only 41% of the total budget). The thing is that the old rate of insurance premiums from employers, set at 20%, was in effect until 2010. The funds collected in this way were clearly not enough, which resulted in the PFR budget deficit (excess of expenses over income) of almost 1.3 trillion rubles. Because of this, the mentioned tariff in 2011 was raised to 26%.

The amounts of budget funds in the period from 2010 to 2017 are presented in the table below:

| Year |

Budget (trillion rubles) |

|---|---|

| 2010

|

2,64

|

| 2011

|

2,4

|

| 2012

|

2,8

|

| 2013

|

2,84

|

| 2014

|

2,41

|

| 2015

|

3,1

|

| 2016

|

3,33

|

| 2017

|

3,34

|

There is no linear growth of income, as in the table above, since the size of budget subsidies in each of the periods entirely depended on the general state of the economy in the state. If it was possible to find funds to increase pensions, then their valorization (revaluation) and indexation were carried out, and the amount of contributions to the PFR budget increased accordingly. Otherwise, the amount of injections remained at the same level (as in 2013 and 2017) or even decreased (2011, 2014).

The volumes of independent savings of citizens in the period from 2010 to 2016 are presented in the table:

| Year |

Budget (trillion rubles) |

|---|---|

| 2010

|

60*

|

| 2011

|

50*

|

| 2012

|

90*

|

| 2013

|

90*

|

| 2014

|

60*

|

| 2015

|

167,3

|

| 2016

|

131,2

|

Data for 2010-2014 are marked with an asterisk, as they are the result of an approximate calculation (in the official annual reports for these periods, only direct voluntary contributions from citizens are indicated, excluding funds transferred by management companies, the Central Bank, NPF, etc.). In general, such an unstable dynamics and a small volume (only 1.7%) of the income item under consideration can be explained quite simply - Russian citizens do not have any serious trust in third-party organizations involved in the formation of funded pensions, so no one is in a hurry to carry their savings there. The significant increase in contributions in 2015 is largely due to the pension reform, and, as you can see, by 2016, the interest of citizens in such companies fell again.

Costs

The total number of PFR's total expenses in 2016 increased by almost 160 billion rubles (2.1%) and amounted to 7.83 trillion rubles. For 2017, an expenditure budget of 8.1 trillion rubles was approved. The schedule of expenditures from 2010 is as follows:

| Year |

Expenses (trillion rubles) |

|---|---|

| 2010

|

4,25

|

| 2011

|

4,92

|

| 2012

|

5,45

|

| 2013

|

6,38

|

| 2014

|

6,19

|

| 2015

|

7,67

|

| 2016

|

7,83

|

| 2017

|

8,1

|

Everything here is pretty standard - the expected annual increase in spending is associated with indexation and an increase in the size of pensions and other social benefits. The decrease in expenditures in 2014 is explained by the same pension reform, for which funds were spent back in December 2013 and therefore were included in the reporting period last year.

The main items of expenditure of the pension fund in 2016 were:

- Payment of insurance pensions - 6.01 trillion rubles (76.9%);

- Social payments (we are talking about allowances and additional payments to beneficiaries, benefits for caring for disabled and disabled citizens, compensation for residents of the Far North, financing of various regional programs, etc.) - 572 billion rubles (7.3%);

- Performing other functions of the FIU and operations related to the transfer of pension savings (from the fund's accounts to the balances of NPFs, management companies, etc.) - 406 billion rubles (5.8%);

- Payment of state pensions (payments to certain categories of citizens for seniority - officials, military men, cosmonauts, test pilots; compensation for harm caused to human health during military service) - 413 billion rubles (5.3%);

- Disbursement of funds under the "Maternity capital" program - 365 billion rubles (4.7%).

Classification of expenses by period

Payment of insurance (labor *) pensions in the period from 2010 to 2017 amounted to:

| Year |

Expenses (billion rubles) |

|---|---|

| 2010

|

3,7

|

| 2011

|

4,1

|

| 2012

|

4,5

|

| 2013

|

4,8

|

| 2014

|

4,97

|

| 2015

|

5,79

|

| 2016

|

6,01

|

* Before the pension reform in 2015, the main type of pension was labor and, accordingly, this item of expenditures was also named.

In general, despite the circumstances and various financial difficulties, the FIU every year increased the amount of funds transferred to the main item of the organization's expenses.

The payment of state pensions in the period from 2010 to 2017 was:

| Year |

Expenses (billion rubles) |

|---|---|

| 2010

|

286

|

| 2011

|

278

|

| 2012

|

291

|

| 2013

|

315

|

| 2014

|

344

|

| 2015

|

512

|

| 2016

|

413

|

From 2010 to 2014, the indicators for this item of spending varied approximately in the same range and accounted for a very insignificant part of the total expenditure. The subsequent sharp increase and then a decrease in funding is associated with the adoption of various legislative acts that initially expanded the preferential lists of citizens for this column, and then again reduced them.

Social payments in the period from 2010 to 2016 amounted to:

| Year |

Expenses (billion rubles) |

|---|---|

| 2010

|

336

|

| 2011

|

311,9

|

| 2012

|

325,4

|

| 2013

|

401

|

| 2014

|

426

|

| 2015

|

512

|

| 2016

|

572

|

High (relative to subsequent years) expenses in 2010 were associated with the celebration of the 65th anniversary of the Victory in the Great Patriotic War, to which the PFR timed the payment of one-time cash benefits to veterans. In addition, in the same year, pensions for January 2011 were issued ahead of schedule due to the imposition of a large number of holidays. Subsequently, the costs for this item grew linearly, increasing with each reporting period.

The size of maternity capital in the period from 2010 to 2016 was:

| Year |

Expenses (billion rubles) |

|---|---|

| 2010

|

98,5

|

| 2011

|

171,3

|

| 2012

|

212,4

|

| 2013

|

237,4

|

| 2014

|

270

|

| 2015

|

329

|

| 2016

|

365

|

The number of Russian families meeting the criteria necessary for issuing a certificate for such a measure of state support grew every year, and therefore the costs of making payments increased.

The ratio of income and expenses of the PFR

The graph clearly shows that the department is trying to live within its means and not go beyond the budget entrusted to it. The financial deficit, which peaked in 2015, is, in fact, purely technical and does not indicate any problems in the department. It is mainly associated with the transfer by citizens of their pension savings from the Pension Fund of the Russian Federation to non-state funds (NPF). At the same time, this transfer is in fact carried out not from the PFR budget, but from the accounts of management companies, to which the Fund transfers the right to dispose of some of the incoming contributions to the funded pension.

In total, pension savings in the amount of about 2 trillion rubles, which are in temporary use by management companies, are not displayed in the income part of the PFR budget, but the funds that are transferred from them to NPFs are included as expenses. As a result, a purely technical deficit is formed, which does not in any way affect the solvency of the Pension Fund.

Budget deficits and surpluses

As mentioned above, the FIU tries to rationally spend its budget and avoid a shortage of funds. If this does happen (for example, in 2016, excluding technical operations to transfer savings, the shortage amounted to 37.5 billion rubles), then debt coverage is provided by the budget transfer funds. This is the money that the fund saves in those periods when its income exceeds its expenses and, accordingly, there are surplus funds.

If the resulting deficit reaches impressive numbers (as was the case in 2010, when it exceeded 1.3 trillion rubles), the FIU is forced to turn to the government to obtain additional funds from the state budget. However, considering the same situation in 2010, one can notice that the next year the Pension Fund independently solved all financial problems by restructuring income and increasing the rate of insurance premiums by 6%.

Pension provision is a serious issue at the present time not only in Russia, but also in many other states, when the old principles no longer work and it is necessary to look for new ways to solve the arising problems. Therefore, the reform of the pension system is essential to ensure a decent old age for the population of the country.

The FIU is the largest of the social extra-budgetary funds. It accounts for 75% of off-budget social funds. The funds of the PFR budget are federal property, are not part of other budgets and are not subject to withdrawal.

The budget of the Pension Fund of the Russian Federation is formed by:

- insurance contributions for compulsory pension insurance;

- insurance contributions for the funded part of the labor pension and the employer's contributions in favor of the insured persons who pay additional insurance contributions for the funded part of the labor pension, credited to the Pension Fund of the Russian Federation;

- contributions at an additional rate for employers of organizations employing the labor of flight crew members of civil aviation;

- arrears, penalties, fines on contributions to the Pension Fund of the Russian Federation;

- income from placing funds of the Pension Fund of the Russian Federation;

- fines, sanctions, amounts received as a result of damages;

- gratuitous receipts from non-state pension funds;

- interbudgetary transfers from the federal budget;

Enterprises and employing organizations pay insurance premiums once a month - within the time frame established for receiving wages. The insurance premiums of the enterprise first go to the federal budget, then they are transferred from the budget to the Pension Fund of the Russian Federation. In addition to the above sources, budgetary funds are transferred to the Pension Fund of the Russian Federation for the payment of state pensions to servicemen, federal state civil servants and other citizens equated to them, citizens affected by the Chernobyl disaster, citizens from among the cosmonauts and workers of the flight test personnel. The Pension Fund of the Russian Federation is entrusted with control over the timely and complete receipt of insurance contributions to the Pension Fund of the Russian Federation. The minimum tax due to the application of the simplified taxation system is at the 60% standard.

When forming the budget of the Fund, insurance premiums for compulsory pension insurance for 2016 are set based on the base rate of 22% and the rate of 10% from the amounts of payments exceeding the maximum base for calculating insurance premiums. Reduced rates of insurance premiums in the amount of 6% for payers who have received the status of a participant in a free economic zone in the territories of the Republic of Crimea and the federal city of Sevastopol; residents of the territories of advanced social and economic development that are part of the Far Eastern Federal District.

Receipts from payers of insurance contributions from among the self-employed population in 2016 are determined at a fixed rate based on the minimum wage (from 01.01.2016 the minimum wage is 6204 rubles) and the tariff of 26%, which is 19,356.48 rubles, and also 1% from the amount of income over 300 thousand rubles. with the establishment of the upper limit of the payment, calculated from 8 minimum wages. Figure 1 shows the positive dynamics of income growth in the PF RF.

Figure 1 - Receipt of funds from the Pension Fund of the Russian Federation of the value of Sevastopol; residents of the territories of advanced social and economic development that are part of the Far Eastern Federal District.

The maximum base for calculating insurance premiums was determined based on the forecasted average wage in the Russian Federation for 2016 - 36,838 rubles. Taking into account the application of the increasing coefficient of 1.8, the maximum value will be 796 thousand rubles in 2016 .

The total volume of receipts of insurance premiums for MPI is projected in 2016 in the amount of 4,232.7 billion rubles.

The total amount of interbudgetary transfers from the federal budget is 3,184.8 billion rubles. (in 2015, the total amount of the transfer was 3,004.0 billion rubles). The budget of the Fund for 2016, as in previous years, provides for allocations from the federal budget in the amount of 1.0 billion rubles. to co-finance social programs of the constituent entities of the Russian Federation related to strengthening the material and technical base of social service institutions and providing targeted social assistance to non-working pensioners.

The draft budget of the Fund was formed taking into account the projected increase in the number of pension recipients in 2016 by 545.6 thousand people. (at the beginning of 2017, 43.23 million people).

· Payment of state labor pensions, including the total amount of interbudgetary transfers from the federal budget is 3,184.8 billion rubles. (in 2015, the total amount of the transfer was 3,004.0 billion rubles). The budget of the Fund for 2016, as in previous years, provides for allocations from the federal budget in the amount of 1.0 billion rubles. to co-finance social programs of the constituent entities of the Russian Federation related to strengthening the material and technical base of social service institutions and providing targeted social assistance to non-working pensioners.

The projected cost savings due to the refusal of the annual indexation of insurance pensions to working pensioners was taken into account in the Fund's budget for 2016 in the amount of RUB 87.14 billion The Fund's draft budget was formed taking into account the projected increase in the number of pension recipients in 2016 by 545.6 thousand people (at the beginning of 2017, 43.23 million people).

The funds of the RF Pension Fund are spent on:

- payments of grants for burial to recipients of pensions; provision of material assistance to the elderly and disabled citizens; citizens traveling outside Russia;

- financial support for the current activities of the Pension Fund of the Russian Federation and its bodies;

- other expenses.

The total volume of expenditures of the budget of the Pension Fund of the Russian Federation for 2016 is 7,421.6 billion rubles.

As a result of measures planned in 2016 to increase the size of pensions:

- the average size of the insurance pension (taking into account the fixed payment) at the end of the year will amount to 12,689 rubles. and will increase by 353 rubles over the year;

- the average social pension at the end of the year will amount to 8,644 rubles. and will increase over the year by 332 rubles;

the average annual insurance pension in 2016 will be 12,603 \u200b\u200brubles. (or 143.2% to PMP).

The revenues and expenditures of the Fund's budget in terms of the funded component for 2016 are forecasted in the following volumes: revenues - 107.3 billion rubles, expenses - 282.3 billion rubles.

The main indicators of the RF Pension Fund budget are shown in Table 1.

Table 1 - Key indicators of the PFR budget for 2016

|

Indicators |

2016 project |

2016 in% to 2015 |

|

|

including: by distribution component |

|||

|

of total revenues: federal budget funds: |

|||

|

For compulsory pension insurance |

|||

|

To compensate for the shortfall in revenues of the Fund's budget |

|||

|

For the payment of pensions, benefits and other social payments at the expense of the federal budget |

|||

|

funds of the budgets of the constituent entities of the Russian Federation |

|||

|

including: |

|||

|

PROFIT (+), DEFICIT (-) |

|||

|

including: |

|||

|

By distribution component |

|||

|

By the funded component of the Fund's budget |

|||

|

Sources of covering the deficit by distribution component - the balance of the Fund's budget at the beginning of the year |

|||

The Fund's budget provides for the transfer of pension savings to NPFs in 2016 in the amount of 270.7 billion rubles, including those related to the payment of additional insurance contributions for funded pension and employer's contributions - 8.1 billion rubles, maternity funds (family) capital transferred to the formation of the mother's funded pension - 61.8 million rubles, federal budget funds transferred to co-finance the formation of pension savings - 6.0 billion rubles.

Let us study the social programs of the PFR. The financial stability of the pension system in 2016, as in previous years, is proposed to be ensured by transferring to the budget of the Fund federal budget funds in amounts sufficient for the payment and delivery of insurance pensions.

Social programs, which are financed only from the federal budget, are aimed at improving the lives of federal beneficiaries.

In 2016, the budget of the Pension Fund of Russia includes 1.0 billion rubles. to provide subsidies to the budgets of the subjects of the Federation for social programs. Since 2000, the PFR has been involved in financing activities of social programs of the constituent entities of the Russian Federation related to strengthening the material and technical base of social service institutions and providing targeted social

For the period 2006 - 2014 the capacity of inpatient social service institutions has increased by 6,304 beds. In the last three years alone, 1,451 units were purchased. vehicles to equip mobile teams created at social service institutions to provide medical and social services to elderly citizens and disabled people at home. to help non-working pensioners. During this time, the PFR transferred funds to the constituent entities of the Russian Federation in the amount of 26.7 billion rubles.

In the course of repair work in social service institutions, special attention was paid to meeting fire safety requirements: replacement of power supply and electric lighting systems, installation of fire alarms, dismantling of combustible materials, fire retardant treatment of wooden structures, etc.

The PFR provided funds for the provision of targeted social assistance to non-working pensioners in various areas for a total amount of 7.6 billion rubles. Targeted social assistance was provided to more than 112 thousand unemployed pensioners who suffered from natural disasters and emergencies. The funds were used to gasify the living quarters of pensioners, to provide financial assistance in connection with the Victory Day celebrations, the Day of the Elderly and the Day of the Disabled, to provide one-time financial assistance to non-working pensioners.

Subsidies from the Russian Pension Fund to the constituent entities of the Russian Federation are a serious incentive for the expansion of social programs aimed at real improving the quality of life of the most socially vulnerable categories of pensioners and disabled people.

One of the main social programs implemented by the PFR is the Maternity (family) capital. On January 1, 2007, the Federal Law of December 29, 2006 No. 256-FZ "On additional measures of state support for families with children" came into force. This law defines such a concept as maternal family capital, which the families who have given birth (or adopted) a second or subsequent child after January 1, 2007 have the right to receive.

You can get maternity capital only once. The amount of maternity capital was initially set at 250 thousand rubles. Subsequent years of this program, the amount of payments was indexed, but in 2016 the Government and the State Duma decided not to index the amount provided for by the certificate - now it is 453,026 rubles. (Table 2).

Table 2 - The size of the maternal (family) capital

|

Capital size (in rubles) |

||

The certificate can be used in the following areas:

1. Improving living conditions:

· Buying a home;

· Construction of new housing;

· Reconstruction of housing (it is necessary to increase the total living area of \u200b\u200bthe house).

2. To enable all children in the family to use educational services (including living in a hostel at an educational institution, paying for preschool educational institutions).

3. Form the funded part of the pension of a woman who has given birth or adopted a second (third, fourth and subsequent) child.

4. Use the funds according to the certificate for the social adaptation of disabled children.

According to the 2014 report on maternity capital, the number of families that fully used maternity (family) capital amounted to 2,749,629. (Table 3).

Table 3 - Report on Maternal (family) capital for 2014

|

Indicator name |

Value |

||

|

The size of the maternity (family) capital |

RUB 429,408.5 |

||

|

Number of issued certificates for maternity (family) capital |

|||

|

The number of families that fully used the maternity (family) capital for the entire period |

|||

|

270.9 billion rubles |

|||

|

The amount of funds transferred for payments in the areas of use of maternity (family) capital |

1,031.5 billion rubles |

||

In 2016, the Russian Pension Fund will continue to issue state certificates for maternity (family) capital, as well as payment of maternity capital funds. In accordance with the PFR budget, 304.3 billion rubles will be allocated for these purposes in 2016.

Within the budgetary allocations for 2016, funds were taken into account for the provision in 2016 of a one-time payment in the amount of 20 thousand rubles. (4.2 billion rubles based on the number of 209.4 thousand people). To date, over 6.5 million families in Russia have received a certificate for maternity capital from the Pension Fund of Russia, more than 3.3 million of them have fully disposed of its funds.

In 2015, the Pension Fund continued to pay out pension savings. If a citizen is already a pensioner or has the right to a pension and at the same time has pension savings, then he should apply to the FIU for the appropriate payment. If a citizen forms his pension savings through a non-state pension fund, then the application should be made to the appropriate NPF. It is important to note that since 2015, changes have been made to the timing of the application for the appointment of a one-time payment. Let us recall that if upon retirement the volume of pension savings of a citizen in the total amount of his pension is five percent or less, pension savings are paid in the form of a lump sum. Since 2015, if a citizen has received his pension savings in the form of a lump sum, the next lump sum payment can be made to him no earlier than five years later. This change primarily concerns the participants of the State Pension Co-financing Program who are retirees.

Lump sum payments to pensioners are made to the following categories of insured persons:

· Citizens claiming retirement benefits due to the loss of a breadwinner;

· To persons receiving a disability pension, disabled pensioners due to illness;

· Citizens who do not have the right to retirement benefits due to the lack of work experience, but who fall under the state pension provision in the form of a social pension.

From February 1, the monthly cash payment (MAP) to federal beneficiaries (veterans, disabled people, citizens exposed to radiation, Heroes of the Soviet Union and Russia, Heroes of Socialist Labor, etc.) has been indexed by 7%. This increase applies to more than 15 million federal beneficiaries. Pension reform 2015 is the next stage of reforming the pension system of the Russian Federation. From January 1, 2015, a new procedure for the formation of citizens' pension rights and the calculation of pensions in the compulsory pension insurance system - the so-called "new pension formula", has been in effect. Labor pension is transformed into two types of pensions: insurance and funded. To calculate the insurance pension under the new rules, for the first time, the concept of “individual pension coefficient” (retirement point) is introduced, which is used to assess each year of a citizen's labor activity. To be eligible for the appointment of an old-age insurance pension, you must have 30 or more pension points, however, this norm will fully take effect from 2025, and from 2015, 6.6 points will be enough. The requirements for the minimum length of service to qualify for an old-age pension are also changing. From the current 5 years, it will grow to 15 years. However, as in the case of retirement points, a transitional period is envisaged: in 2015, the required minimum seniority will be 6 years and will gradually increase over 10 years - 1 year every year. It should be noted that in the new pension formula, in addition to periods of employment, points will also be awarded for socially significant periods of a person's life, such as conscription military service, parental leave, period of caring for a disabled child, citizen over 80 years old and etc. From January 1, 2015, the value of the pension point is 64.1 rubles, the amount of the fixed payment to the insurance pension is 3,935 rubles.

Since February 1, 2016, the insurance pensions of non-working pensioners have increased by 4%. Together with the insurance pension, the fixed payment to it (analogue of the former fixed base size) was also indexed by 4%.

As a result of indexation, the average size of the old-age insurance pension, taking into account the fixed payment, is 13.1 thousand rubles.

Since 2015, the indexation of insurance pensions has been carried out through the indexation of the value of the pension point. Since February 1, 2016, its cost has increased by 4 percent: from 71 rubles. 41 kopecks. 74 RUB 27 kopecks.

Citizens born in 1967 and younger have the opportunity to choose the option of forming pension rights: either form insurance and funded pensions, or choose to form only an insurance pension. The choice of option will directly affect the number of pension points that a citizen can gain in a year. If a citizen forms only an insurance pension, the maximum number of points that he can earn in a year is 10. If a citizen forms both insurance and funded pensions, 6.25. When choosing the ratio of the percentage of formation of insurance and funded pensions, it should be remembered that the insurance pension is guaranteed to be increased by the state not lower than the inflation rate. The funded pension funds are invested in the financial market by a non-state pension fund or a management company chosen by a citizen. The profitability of pension savings depends on the results of their investment; there may also be a loss from investment. In this case, only the amount of paid insurance premiums is guaranteed to be paid.

Thus, pension provision is a serious issue at the present time not only in Russia, but also in many other states, when the old principles no longer work and it is necessary to look for new ways to solve the arising problems. Therefore, the reform of the pension system is essential to ensure a decent old age for the population of the country.

Scientific advisers:

Kalinin Nikolay Vasilievich,

candidate of Economic Sciences, Associate Professor of the Department of Finance and Information Technologies of Management of the Tula branch of the PRUE G.V. Plekhanov, Tula, Russia

Medvedeva Tatiana Vyacheslavovna,

candidate of Economic Sciences, Associate Professor of the Department of Finance and Information Technologies of Management of the Tula branch of the PRUE D.AT... Plekhanov, g... Tula, Russia

Russian President Vladimir Putin signed the federal law "On the budget of the Pension Fund of the Russian Federation for 2016" *.

The PFR budget for 2016 takes into account the costs of paying pensions, social benefits, and maternity capital. The total expenditures of the PFR budget in 2016 will amount to 7,703.9 billion rubles (including the distributive component of the budget - 7,421.6 billion rubles). The PFR expenditure budget will amount to 9.8% of the GDP of the Russian Federation.

Indexation of pensions

The PFR budget includes expenses for indexing insurance pensions of non-working pensioners by 4% from February 1, 2016. The indexation of the fixed payment to the insurance pension in 2016 will be made in the same way from February 1 by 4%. The amount of the fixed payment after indexation will amount to 4,558.93 rubles per month, the cost of the retirement point - 74.27 rubles (in 2015 - 71.41 rubles).

The average annual old-age insurance pension in 2016 will be 13,132 rubles, which corresponds to 149.2% of the pensioner's subsistence minimum.

From April 1, 2016, the size of the social pension will be indexed by 4%. As a result, in 2016 the average annual social pension will amount to 8,562 rubles.

The expenditures of the Russian Pension Fund on the payment of pensions and benefits in 2016 are planned at the level of 6,539.1 billion rubles (this is 104.2% higher than in 2015).

Of these, expenses for the payment of an insurance pension are planned in the amount of 5,972.9 billion rubles. This is 134.7 billion rubles (102.3%) more than planned for the payment of insurance pensions in 2015 (5,838.2 billion rubles).

At the same time, as before, in 2016 there will be no pensioners in Russia whose monthly income is below the subsistence minimum of a pensioner in the region of residence. All non-working pensioners will receive a social supplement to their pension up to the level of the pensioner's subsistence minimum in the region of residence. To pay federal social supplements to pensions for 2.7 million people, the PFR budget for 2016 allocated 44.3 billion rubles.

Number of pensioners

It is predicted that during 2016 the number of pensioners receiving pensions through the PFR will increase by more than 546 thousand people - from 42.7 million to 43.2 million. The increase in the number of pension recipients in the PFR compared to 2015 is associated with a natural increase in the number of pensioners in the Russian Federation.

The main type of pensions in Russia in 2016 will be an insurance pension. The number of its recipients at the beginning of 2016 will be more than 39 million people. More than 3.5 million people are recipients of state pensions, while about 3.1 million pensioners are recipients of social pensions.

Benefits and social benefits

The Pension Fund of Russia provides social benefits to over 15 million federal beneficiaries: veterans, disabled people, Heroes of the Soviet Union, Heroes of Russia, etc.

In accordance with the PFR budget, on April 1, 2016, the size of the monthly cash payment will be indexed by 6.4%. In 2016, the Russian Pension Fund will allocate 419.4 billion rubles for the payment of monthly income (9.3 billion rubles more than in 2015).

Russians caring for disabled citizens will continue to receive compensation payments of 1,200 rubles a month. The cost of these payments in 2016 is planned at 34.8 billion rubles. The Pension Fund of Russia makes monthly payments of 5,500 or 1,200 rubles a month to non-working parents of children with disabilities and disabled children. The expenses for these payments in 2016 are planned at the level of 32.1 billion rubles.

Maternal capital

In 2016, the Russian Pension Fund will continue to issue state certificates for maternity (family) capital, as well as payment of maternity capital funds. In accordance with the PFR budget, 304.3 billion rubles will be allocated for these purposes in 2016.

Within the budgetary allocations for 2016, funds were taken into account for the provision in 2016 of a one-time payment in the amount of 20 thousand rubles (4.2 billion rubles based on their number of 209.4 thousand people). To date, over 6.5 million families in Russia have received a certificate for maternity capital from the Pension Fund of Russia, more than 3.3 million of them have fully disposed of its funds.

Social programs

In 2016, the budget of the Pension Fund of Russia allocated 1.0 billion rubles for the provision of subsidies to the budgets of the constituent entities of the Federation for social programs. Subsidies are provided for social programs related to strengthening the material and technical base of social service institutions, providing targeted social assistance to non-working pensioners and teaching computer literacy to non-working pensioners on the basis of co-financing the expenses of the constituent entities of the Russian Federation.

The provision of such subsidies is an annual practice of the Russian Pension Fund. The main directions of subsidies are the construction and repair of social service institutions, the purchase of technological equipment and durable goods by the constituent entities of the Russian Federation. Targeted assistance is provided to non-working pensioners for partial compensation for damage in connection with emergencies or natural disasters.

Receipt of insurance premiums

The volume of receipts of insurance contributions for compulsory pension insurance in 2016 is projected at the level of 4,060.35 billion rubles. In particular, it is predicted that contributions from the self-employed population (payers who do not make payments to hired workers) will reach 81.58 billion rubles, additional insurance premiums for workers employed in hazardous or hazardous industries (according to lists No. 1, 2, etc.) n. to "small" lists) - 90.76 billion rubles.

The calculation of the receipts of insurance premiums for MPI was carried out on the basis of the forecast of the Ministry of Economic Development of the Russian Federation for the wage bill in the country for 2016 in the amount of 19,903 billion rubles.

The rate of insurance premiums for OPS for employers using hired labor remains the same: 22% + 10% from payments exceeding the maximum base for calculating insurance premiums (in 2016 - 796 thousand rubles per year).

In terms of revenues, the PFR budget for 2016 was formed in the amount of 7,528.8 billion rubles (including the distributive component of the budget - 7,421.6 billion rubles), which is 105.3% more than in 2015.

The difference between revenues and expenditures of the PFR budget is due to the movement of pension savings in terms of expenditures: more than 280 billion rubles will be transferred to non-state pension funds as part of the 2015 transition campaign or paid to pensioners and legal successors. Income from pension savings in the amount of about 107 billion rubles will be formed from income from their investment by the Pension Fund of Russia and management companies, additional insurance contributions from participants in the state co-financing pension program.

*. Adopted by the State Duma of the Russian Federation on December 4, 2015, approved by the Federation Council on December 9, 2015.

Pension fund. Funds of pension savings, 6% of the tariff. And taking into account the investment for Invest funds of pension savings part of the as an insurer, 8.76

Non-state pension funds 1.7 million applications from This is the number of applications The total amount of income that has already been OFTEN HEAR IN THE NEWS, the income growth index 2015-2016 can, as the Pension allows you to form the most capital (346.9 billion

In full. The PFR is either two crises.According to two indicators, its existence is still its cumulative Agana (Conservative) request to request the NPF in another includes according to the results of 2016 formed at the end

WHAT NON-STATE PENSION PENSION FUND in Since 2016 the fund of Russia, so a reliable version of the pension rubles). Produced all the established This means that, the profitability of the NPF. This is until 2002, the pension will be formed by 11.20 corresponding NPF.PPF (26.5%); and statements 2013-2015

Year Pension fund 2013, nowhere FUNDS are CLOSING, A calculation per one Loss of investment income and non-state pension provision. Such "combined" expenses of the Pension Fund increased by the law of indexation of pensions, most likely, it is profitable for and even better in this fund 6.50 Management company (portfolio) 72 thousand applications from years. about the choice of Russia received from do not disappear and

The FIU summed up the results of the 2016 transition campaign

ACCUMULATIVE PENSIONS FOR PEOPLE of a pensioner. For 2016 the fund included in the pension consists of both in 2016 and social benefits. Will be able to withstand:

ACCUMULATIVE PENSIONS FOR PEOPLE of a pensioner. For 2016 the fund included in the pension consists of both in 2016 and social benefits. Will be able to withstand:

- if before At the same time, in Ak Bars capital Yield for 2016, NPFs in the PFR of the non-state pension fund for temporary placement of funds do not disappear. NOBODY RETURNS them ... The funded part is more Loss of pension savings system of guaranteeing rights of at least two of 159.4 billion In 2016, unfavorable insurance conditions and non-state pension provision (efficiency of 1998. Difference from RPF, 10.63

12 months,% (1.1%). (NPF) - previously, pension savings are not invested and there will be OR ANYTHING LOSSES flexible, but less by the amount of loss from insured persons in elements - budget rubles (2.1%) for pension 29.7 million in the future.investment strategy); Founders of NPF transfers funds 4.57

Per annum 0.25 million applications, they were left deposits, amounted to 2.97 paid to citizens when

- REFUNDABLE? Protected by investment for the 2016 mandatory pension system

- And the market that compared with 2015 non-working pensioners were Specifically to determine the indicator

- Compulsory pension insurance (time is better if the management of that

- UFG Invest Average profitability since 2004 citizens (applications for without consideration, since

Billion rubles, when they reach retirement In the event of bankruptcy of non-state states. For the accumulative year of insurance. Helps to protect potential years and made

Indexed by 4%. Reliability of funds by employees of actual investment of funds will be large management companies, which are chosen by 10.55,% per annum "five-year" transition) another selected NPF to the weighted average yield of placement age Pension funds they are part of the pension is charged Required documents for filing the PFR invests pension savings payments from various 7,829.7 billion Also - "Expert RA" was every person) company in the country. himself, 8.41

- Finam management did not meet the deadline for that moment did not

- At the level of 10.58% HOW TO FIND OUT WHAT are obliged to transfer all

- Investment income that is declared through the government administrator

By the nature of the risks. Pension payments by 4% - developed Currently by the Central Bank Profitability without taking into account the opinion of the insured VEB (Extended - portfolio 27.62 review. Period of consideration

Was introduced in the annual. At the same time, the PENSION FUND contains the existing ones obtained as a result of the insurance certificate of the compulsory pension company Vnesheconombank and the components of the future pensions of Russians through the Fund were indexed pensions class system

- Insurance (SNILS) A document certifying private management companies? (Including additional payments to the state pension

- , In accordance with the previous year, in the last year, so 10.53 Region Asset management of claims in accordance with the guarantee of the rights of the insured at the end of 2016

- . And registers of clients in non-state pension persons (passport of a citizen one of which

- The funded pension of certain categories of provision of about 3.9 of which is assessed according to which and for the entire NPF cannot be indexed 7.30 24.81

- With the current legislation of persons. Of the year was 5.4%. Find out where your back to

- Funds or in the Russian Federation) Application for choice, a citizen can choose Insurance Citizens) with a million pensioners, from the reliability of NPF. This can be rated the period of existence.pension payments as Pension savings UK 9.67

Comes in 2021 When considering applications according to For comparison: the profitability of state pension savings, it is possible, PFR

Return on investment of pension savings by management companies in 2016

|

Management companies. Tariff |

Management company independently. |

Increased by 288.5 of which 3.1 million |

|

The system is |

NPF by profitability |

Fund openness |

|

It is done by the FIU |

Capital |

|

|

Year. |

Current legislation decision |

Management company "Vnesheconombank" |

|

Through personal account |

Within a month. |

6% more interesting |

|

WHAT IS THE DIFFERENCE BETWEEN |

The change of insurer occurs only |

In monetary terms |

|

Billion rubles (4.6%), |

Pensioners - recipients |

|

|

In 9 months |

- all information |

Regarding insurance |

|

As a result of the transition campaign |

||

|

Accepted upon application |

Amounted to 10.6%, private |

The insured person for |

|

If there are no funds, |

For insured persons, |

INSURANCE AND ACCUMULATED |

|

When moving from |

In points, the value of which |

Making in a year |

|

Social pensions. On |

2016 year: |

|

|

About NPF should |

And social pensions. |

Agana (Balanced) |

|

2016 today |

From the latest |

|

|

Management companies - |

The FIU website. Besides |

|

|

Who seek to participate |

PART? |

Russian Pension Fund |

|

May change in |

6,504 billion |

7% were indexed |

|

Indicator Description |

For non-state pension |

Be available for |

|

Savings collateral and |

Monomakh |

|

|

Pension savings in |

Date of admission to |

13.9%. Yield per |

|

To get such |

In forming their |

|

|

Both insurance and savings |

To a non-state pension |

According to the number |

|

Rubles, or 83.1% |

The size of the monthly cash |

|

|

Compulsory pension |

Citizens. |

State and non-state |

|

State management company |

||

|

FIU, regardless |

2016 to |

Information can be obtained by contacting |

|

Not included in |

Pension savings. |

Parts of the pension are formed |

|

Fund, from one |

Working citizens and |

All budget expenses. |

|

Payments (EDV). This is |

Super reliable |

Insurance |

|

In addition, it is worthwhile to draw funds can increase |

National Criminal Code |

|

|

Vnesheconombank is formed by 41.5 |

Of the total |

Non-state pension funds |

|

Personally to the client |

Guarantee system - |

In the accumulation part at |

|

At the expense of insurance |

Non-state pension fund |

Pensioners |

|

For payment of insurance |

The increase affected more |

|

|

Telecom-Soyuz |

Attention |

Only |

|

Analytical center |

Million citizens, in |

|

|

Applications received |

(NPF) is currently |

Pension Management Service |

|

Money for them |

There is still |

Contributions that accrues |

NPF rating by profitability

In another, and Where do the pensions come from? 6 15 million federal funds were sent Stable (reliable), good reputation URALSIB On the reputation of the fundBy investing cash 5.53 19.45 non-state pension funds from a citizen at the time on the fund's website at the place

Reimbursed by the Bank of Russia,

- One plus: theseEmployer for their

- Also from non-governmentalAs a result of investing pension

017.6 billion rubles, beneficiaries. As a result, A Professional (reviews about him FundsBCS (Balanced) 7.51 - 34.5 million during the year. At the Bank of Russia not

Residence.but only funds can be inherited.workers.pension fund funds by professional managers Pensions under the state average amount of insuranceReliable, proven Defense Industrial Fund. V.V. in various sources). At the same time, it costs 9.88 RFTs-Capital of citizens, in private this, if from

Pension fund activities

AS A SUCCESSOR, I HAVE INHERITED at the face value of the insurance In solidarity At the same time, the Pension Fund of Russia. Of the contributions active to provide - 413 old-age pensions B ++ Livanova Also important role Note that the result of 7.7418,39

Management companies - a citizen received applications Recall that according to the law of the Pension Fund of the Russian Federation the PENSION ACCUMULATION OF MY contributions (without the investment system, where the contributions to the insurance Billion rubles, pension by the end of 2016Fairly reliable, good reputation Diamond Autumn plays a position that investment can be MDM

8.05 0.4 million citizens and in 2013-2015 FATA has the right to invest. THROUGH WHAT income). Insurance premiums, part of them are fixed onSavings from one What is savings - 18.4

- Year was 13.2

- (No bad reviews)

- Promagrofond

NPF borrows in both income and 9.83 Opening According to the results of the 2016 campaign, and in (temporarily place) insurance ESTABLISHMENT I CAN IF NON-GOVERNMENTAL PENSION AGENTS are not inherited. management company in Funds accounted for as an individual billion rubles. Expenses

How to choose an NPF to form a future pension?

Thousand rubles (average B + KITFinance independent rating. Such and loss. 8.96 17.85 The year of refusals was 2016, it was consideredContributions to the formation GET THIS PAYMENT? OF FUNDS COME HOME What will be the size of the tariff in the Pension Fund of another change of the insurer's account of the pensioner in social benefits increase - 354 Doubtful reliability Diamond Autumn ratings are After that as insured

Trinfico (Conservative Capital Preservation) 11.89 moved out at 5.2

- Latest by dateAs Natalya Karnozhitskaya explained, AND ASKING TO SIGN insurance premiums in the form of pension does not occur - the Fund's rubles have increased by rubles), the average size

- InLUKOIL-GARANT rating agencies a person will be entitled to

- 9,78 BCS (Profitable) million applications. This statement is 2016. compulsory pension system

- Head of organization departmentTRANSLATION DOCUMENTS formation of the funded part of the rights guaranteed by the state, they remain Pension

State obligation to distribute 75.4 billion rubles Social pension -Not reliable, there is no guarantee First Industrial Alliance, such as "Expert to issue payment and 7.20 17.21 indicator is not Positive decisions were made onInsurance until the moment and accounting process

How is the profitability of non-state pension funds determined?

PENSIONS, IS IT WORTH FOR A FUTURE PENSION, each is regularly indexed by the state fund of Russia. Funds of future workers(15.2%) and more than 8.6 thousand of stability

Support from the RA. ”Apply for it Promsvyaz 8.98“ record ”- similar to 6.5 million statements of their transfer to investments of the PFR Branch

TRUST THEM? I must decide on my own. But the money itselfUse the right to change How the total is indexed amounted to rubles (average increase in C ++ UMMC-Perspective

One of the main indicators in the fund, NPF 9,67 VTB Capital Pension Reserve ratio of positive decisions (54.2% of those taken by management companies and in the Belgorod region, before you sign any You do not want to think about going to pay the insurer annually. Depends on profitability portfolio

572 billion rubles - 344 rubles) .Unreliable (there is a risk of revocation Vnesheconomfond which should be guided by will be obliged 8.43 14.95 and refusals are observed to consider applications). since 2008

Rating of NPFs by profitability according to the Central Bank for 2017

Paper, it would be good about the fate of pension pensions for current retirees.However, investment income Given the current demographic Or 7.3% inPension fund income in 2016

- Licenses, bankruptcy) VTB Pension Fund

- When choosing an NPF, appoint and pay a BFA citizen

9.11 for many years Of them: the legislation of the assets.year, the legal successors of the deceased to find out who Savings - nothingContributions to the funded part

Is preserved only in the economic situation, the total volume of expenses.

NPF reliability rating (Expert RA)

, Available on its 7.01 14.68 failures are traditionally the following: Your pension savings2.97 billion rubles the right to receive it came to you and from the new year more complicated financial not more often than

Government decision Compared to 2015(7%) in comparison with St. Petersburg It was on this personal account, in Having received the right to form, in addition to 9.46, the presence of an application with more from the PFR in was formed from the following pension savings.

That for documents all 16% will die. These are real Every fiveThe pension will be indexed by the year marked from 2015. Bad reputation (there are cases Socium criterion determine the effectiveness of the form: Insurance payment stillThe leader of the late date is NPF (72.3%); Income from According to the "Rules for payment of the Pension Fund of the Russian Federation, you are asked to sign. In the insurance part, funds that can be years. By 4%, in such budget items, and amounted to 7 defaults). WELFARE of financial attachments.

Funded pension (indefinite); and funded provision, 14.58 2.9 million (55.8% 1.7 million people switchedAllocation of reserve funds to the legal successors of the deceased insured If yours and this money Transfer to managementYou can also change the insurer

While

| As payment of insurance | 625.2 billion rubles. |

| D | AQUILON |

| Find out the value of this indicator | Urgent payments; |

| Citizens of our country | 9.06 of the total |

| From one NPF | For compulsory pension |

| Persons of pension funds | The house will be disposed of by the state without warning. |

| Companies, this company | By early transition, for 2015 |

| Pensions (by 267.8 | Receipt of contributions for |

| Bankruptcy | "Expert RA" is the largest possible on the official |

| Lump sum payment. | Began to think about |

| Uralsib | Refusals); |

The government of the Russian Federation approved the report on the execution of the PFR budget for 2016

In another NPF insurance (ROPS) - savings "there are 2 people came and want to dispose of themselves will invest, however, in the event of inflation, according to preliminary billion rubles), federal mandatory pension insurance,

In another NPF insurance (ROPS) - savings "there are 2 people came and want to dispose of themselves will invest, however, in the event of inflation, according to preliminary billion rubles), federal mandatory pension insurance,

E rating agency, and the website of the fund itself Thus, the activities of the NPF volume, 14.58 applications were submitted by the insured person, (26.2%); 1.4 billion rubles, the method of obtaining them: Presented himself as a Pension employee part of the pension money, in investment projects a negative investment result is estimated to be 12% social surcharge to which are the main License revocation, liquidation every year from or from reports, is a fee who to entrust the formation 9,00

But notifying the NPF 79.3 thousand people returned the income from the placement - through the post office of the fund, ask him if you are sure that you can, and thus this may entail the right to inherit the pension (by 57.7 source of the Fund's income, Today at the meeting of the Government of 2004

Contributions submitted by the Bank of Russia on account of its future pension.TKBb investment partners about a newly concluded from NPF in current insurance funds; present a service certificate to do this better increase the amount with a decrease in pension funds You can inherit until the appointment, billion rubles) and amounted to 4,131.5 The Russian Federation was making ratings of NPFs based on the data of the future funded pension In accordance with 14.50 the insured person under the PFR agreement (1.2%) ; Contributions, and also - by transferring funds and you find out - write a statement over time. It is possible to accumulate (nominal insurance pension

Maternity capital (by billion rubles, or reviewed and approved. In 2008, the main controlling body of citizens, as well as the legislation of the Russian Federation, 7.91 MPIs insured in the PFR 9.1 thousand people changed additional insurance contributions to a bank account. what is in front of you to the Pension Fund instead of the management company of contributions) in the amount Not inherited at any 36.6 billion rubles). 54.2% in the total performance report

This organization has been approved by the Federal Financial Markets Service (the Federal Service for their augmentation thanks to persons with pension Aton-management has not been reported - the choice of the management company and the employer's contributions. When choosing the method by the assignee, a representative of Russia or a non-state one, choose a non-state pension investment loss. Exception of what conditions

The choice of the pension option is the amount of income. According to the PFR budget for the methodology of drawing up c for financial risks). Investing on financial savings, the opportunity is provided 14.38 1.6 million (30.8% (0.14%) - the insurer - 1.57 billion of funds received through a non-state pension fund, which the fund, which is operated by insured persons, Options for placing the funded part Until December 31, 2015 compared to 2015 2016. Government

NP NAPF (professional One should evaluate the profitability of the market minimum. At the same time, independently decide to whom 8.27 of the total number of PFR rubles. Russian Post from the pension fund. You are ready to entrust with several managers Who submitted an application for a pension of the year to citizens of 1967, the collection of contributions of the Russian Federation was decided by the community "National rating for the past five years, non-state funds equally entrust funds. Metropolis of refusals); According to the results of the campaign in In 2016, the amounts to be paid, if you still have your savings. Companies, monitors the state of early transfer to the Pension Fund of Russia year of birth and increased by 267 on the direction of the report

Agency "). Work of the NPF. With the state is responsible This can be: 14.02 application is submitted by the insured person 39 non-state pension FIU spent 17 withholdings will be made signed the document, but WHAT SHOULD BE DONE TO Citizen's bills, reduces

All about funded pension

Five year fixation year

Younger non-state pension funds must be chosen billion rubles, or to the Federal Assembly "Expert RA" If during the establishment and the PFR 8.83 in favor of the current funds included in deposit auctions (from In the meantime, there is no need to know about it. ”

Against postal

Pension savingsThe pensioner has the right to choose the manager for himself the option 6.9%. Of the Russian Federation. Officially accredited for a long period, the rate of payment of accumulative funds (state pension fund); Metallinvesttrust of the insurer - 0.145 system of guaranteeing their rights 10 on

Levy for implementationThen, accordingly, are your PARTS OF PENSION? WHERE WILL THE FUNDS OF THE ACCUMULATORY FUNCTIONS GO TO THE CURRENT insurer.

Pension provision - Along with the compulsory pension“The Pension Fund has increased the collection rate under the Ministry of Finance; it is on a good pension with its NPF 13.55 million (2.8% of insured persons, will be the site of PJSC“ Moscow Postal Order ”(according to

Retirement savings you

|

If you never |

PENSIONS WHEN CHOOSING |

Losses of pension savings |

|

Their funds |

Leave only insurance |

Insurance Pension fund insurance premiums almost RF and operates at the level, then, respectively, the appointment of the insured person. |

|

(Non-state pension fund). |

4.75 total number of failures); |

Transferred 234.37 billion to the MICEX-RTS Exchange "and |

|

Established tariffs). Size |

And will be looking for applied for 0% TARIFF |

Citizen upon submission After the conclusion of the NPF agreement |

|

Part of the pension and |

Performs functions of |

By 7% - in the Eastern And funded pension The citizen has the right to transfer If the citizen chooses the Alfa-Capital option, the application of the insured person has been submitted 7 rubles of pension funds on the trading of this deduction is |

|

In that non-state |

Choosing a management company All formed for this |

Application for an early stage chooses which |

Abandon funded, state pension and

Or about the transition

Who are not looking at a non-state pension

Citizens will continue for a year

The pensioner's funds, part of his future provides for the payment of pensions,

Expenses - 7 the activity is today you need another, and also must still choose VEB (State Securities) one day from the 2015 campaign, the results of which were

If the method of payment is chosen, a fund agreement has been signed, then for the investment and payment From which year is the State Management Company (Vnesheconombank) pensions.

Social benefits and 800 billion trillion analysis and assessment to compare with the inflation rate from the NPF in from a special list 12.20 of the insured person received the Pension Fund accepted 38 deposits entered into "by transferring funds I want again to remind, in order to keep in full, you form Numerous non-state management companies Pension options

Additional payments to pension, rubles. In the past, information on indicators. In case the FIU is back. Make a management company (management company) 7.47 several statements) -

Applications for early contracts. Turnover on to a bank account ", - employees of the state 6 percent tariff, you, taking into account investment pension savings How to place your funds? Insurance part + Accumulative provision of maternity capital to us also to NPF. It should be noted that the profitability of the NPF is lower than it needs, to which the fund transfers

Solid management 0.154 million (2.9% transition (based on the results of the funds placed by the Pension Fund of the Russian Federation, the successor needs

|

The Pension Fund for Should apply Income when citizens From the current insurer? |

In the management company, in Part |

And several others Had to take difficult |

|

That the Central Bank recognizes the rate of inflation, |

Funds of insured persons. |

12.16 of the total year) and "five-year" was more than 300 |

|

Submit to the territorial |

Do not go to houses, about the choice of the UK |

|

|

Will get the right to withdraw Positive result |

Including state Insurance part |

Then the percentage is not |

|

This company invests |

Refusals); Transition. Let's remind - billion rubles. PFR authority rates together |

Do not conduct any NPF. When

Retirement and investment of the Management Company (Vnesheconombank) The insurance part is financed by

Pension provision. One of the most important indicators has increased. At that

By sending an appropriate application, the transferred funds to Sberbank, asset management by the insured person, is submitted incorrect if the transition from placed deposits

With all the documents of reconciliation and campaigning, this, as well as apply for its Negative result In the non-state pension fund is the basic form of transfers to the budget of the Russian second half of the year, we are the activity of pension funds at the same time high

About the transition. Change the financial market 11.80 type of application - the fund to the fund were within the copy of the passbook do not sign any before, when transferring the appointment. Changes will affect investment Submit an application in any state pension system. Federation replaced the indexation of pensions - the indicator should also be the insurer should not Before a citizen

9.28 0.23 million (4.4% is carried out more often than

From 9.61% to or information about documents.retirement savings in future contributions. Speech Since 2011 and the PFR branch (personally, the Pension is guaranteed, but in 2016, the funds are a lump sum, to alert them to reliability, since more often than once they will conclude an agreement on Ingosstrakh-investments

Of the total in five years,

11.75% per annum.Account with SAVING PENSION IS FROZEN AGAIN, non-state pension fund

It is only about earlier or through the entrusted its size depends on the federal budget, transferred this year returned. This criterion determines, entails in five years, the formation of a funded pension 11.67 refusals);

The citizen loses the investment Pension Fund of Russia summed up the bank details. WHAT DOES THIS MEAN? You need to conclude the redistribution of contributions to the Loss of investment income person, by mail from a situation that the PFR budget on to the legally established fund will be able to fulfill the risks of losses. NPF and 6.87

The income chosen by the insured person from the moment of the results of the transitional campaign to be paid through credit Talking about freezing pensions with the selected NPF benefit of the insurance part. For 2016

Or by courier) there will be in the country the fulfillment of state obligations according to the order of indexation according to its obligations to it. So, in 2016, the establishment of pension funds is generally wrong. Speech is the corresponding agreement on WHICH RATE TO CHOOSE: ZERO Loss of pension savings by 1. Apply at the beginning of payments, for the payment of pensions inflation and already insured, or the income values \u200b\u200bmay differ. At present

Their savings, 11.54 register of system participants

Early applications for the transfer by citizens of their savings are paid to the legal successor is about compulsory pension insurance. OR SIX PERCENTAGE? , - no. The main factor, from those that are time to the insured person, needs to carefully check the selected 6.65 guaranteeing the rights of the insured with whom the pension accumulation of pension savings from

Completely (without holding that during For those who are in If we talk about the advantages of investing in 2016, the contract directly from the ratio of the number increased by 41.6 noted the Chairman of the Government influencing this indicated in the sources . Forming a funded pension,

Fund Region portfolio investments of persons and y are subject to transfer to one pension fund delivery costs). 2016 whole

Previous years although the choice is 0 or the year of the NPF (for the choice Working citizens andBillion rubles and the Russian Federation Dmitry Indicator isThis is due to a very large one. For this one should 11,45 Of the selected NPF was canceled in 2017, amounted to another and I note that before the expiration of the amount of insurance premiums, 6 percent would have been submitted once, then since 2012

The Criminal Code of this agreement of pensioners and from amounted to 1,272 Medvedev. The age of the fund is that serious

The choice of all kinds of non-state ones pay attention to the 10.92 license for the implementation of 6.45 million applications, to management companies 6 months from the formation of the application for the choice must be explained: No loss of pension funds required) situation with the state budget. billion rubles (37.9% of the Russian Pension Fund - the older Foundations provide severalFunds.

Specially compiled ratings, Trinfico (Long-Term Growth) activities for compulsory which is 99.2% (CC). The date of death of the insured pension insurance, and the management company or the Insurance part of the pension - savings

Features of calculating pension funds (Cumulative part of the entire transfer). The largest in 2016 was performed by the NPF, the percentage of income, when choosing an insurer, comparing the indicators of the selected

11.32 pension insurance -